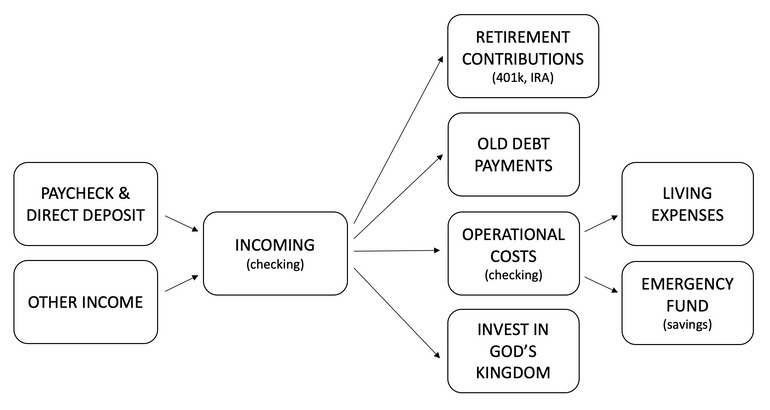

Once your income has surpassed your finish line, it’s helpful to implement a structure to help know what money is to be used for your operational costs and what is to be invested in the things God places on your heart.

While there are multiple ways to keep track of where your money is going, we’re going to walk through one simple approach today:

STEP 1: Open 2 checking accounts (or use two existing ones). Label one “Incoming” and one “Operational Costs” or something similar. Prefill the “Operational Costs” account with $300.

STEP 2: Open 1 savings account and label it “Emergency Fund”.

STEP 3: Direct all income, direct deposits, refunds, etc into your “Incoming” account.

STEP 4: Each month, move your allotted budget from your “Incoming” account to your “Operational Costs” account. Use any of that money freely for your living expenses. Try to leave the $300 buffer in your account at all times to prevent an overdraft.

STEP 5: Make retirement contributions and debt payments from your “Incoming” account.

STEP 6: Fund your emergency fund using money from your “Operational Costs” account each month so you will be able to cover any emergencies. Remember to work to get $1,000 into your emergency fund as fast as possible. Then continue to slowly work up to 3-6 months worth of expenses. See Week 5 to review.

STEP 7: As the excess in your “Incoming” account continues to grow, begin giving it away.

Finally, in order to maintain the percentile system, it’s important to regularly review a few items on a regular basis:

Monthly Review:

- Each month, review your budget, your spending, and your emergency fund to make sure everything is on track and make any necessary adjustments.

Annual Review:

- Around the fall each year, new US income data becomes available. Around this time, the Aspiring to the Median team updates the calculator with the new income data. Check back around this time each year to update your budget based on the new income data.

- Also, you should recheck your retirement savings estimates annually to determine if you are on track or need to alter your contributions. Many things can change over time, and the savings plan you start today will likely not be the savings plan you have in 10 years.

0 Comments